working capital funding gap in days

Working Capital Financing is when a business borrows money to cover day-to-day operations and payroll rather than purchasing equipment or. 456 days in the period.

Working Capital Financing What It Is And How To Get It

According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after.

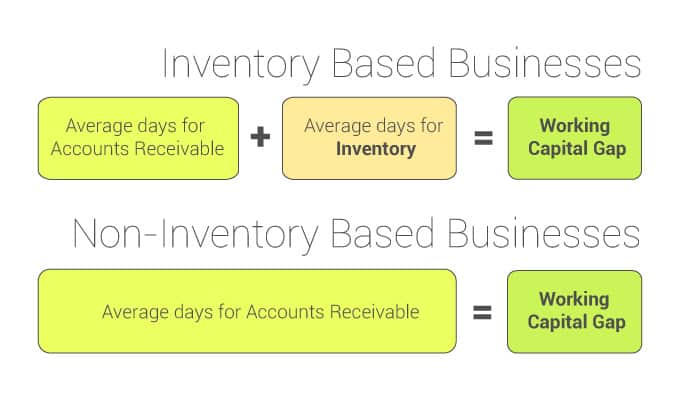

. Apply Now Funding Criteria Fico. Working capital funding gap in. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999.

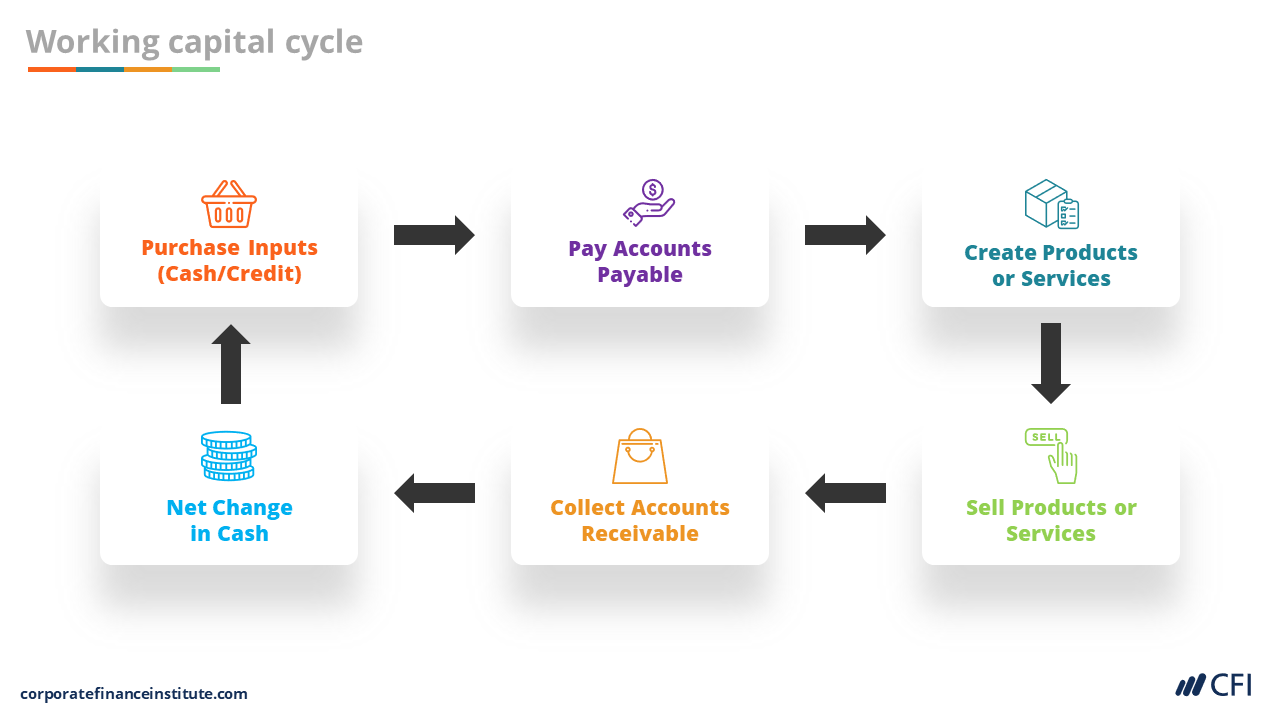

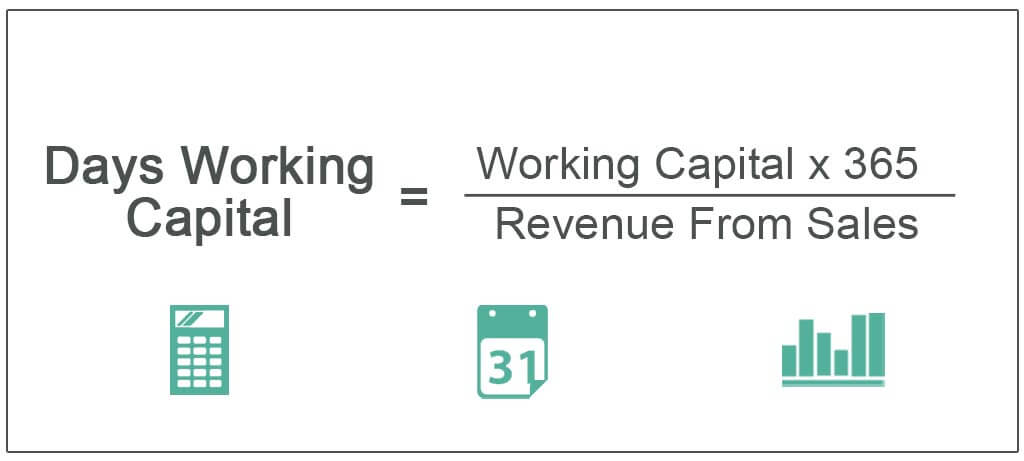

365 413 361 583 329 based on the information below how much does the company need to finance the. And this is exactly where working capital management comes in. Working Capital Days Receivable Days Inventory Days Payable Days.

Working capital increases because accounts receivable goes up by 50000 and inventory decreases by 41000. This ratio measures how efficiently a company is able to convert its working capital into revenue. The cash gap drops to only 40 days even if management does nothing to change the collection or payables periods.

1 11 Best Way to Manage and Improve. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. 345 payable days.

472 inventory days. The key components of the working capital requirement formula are accounts receivable measured through the DSO for Days Sales Outstanding inventory measured. Working capital gap Current assets.

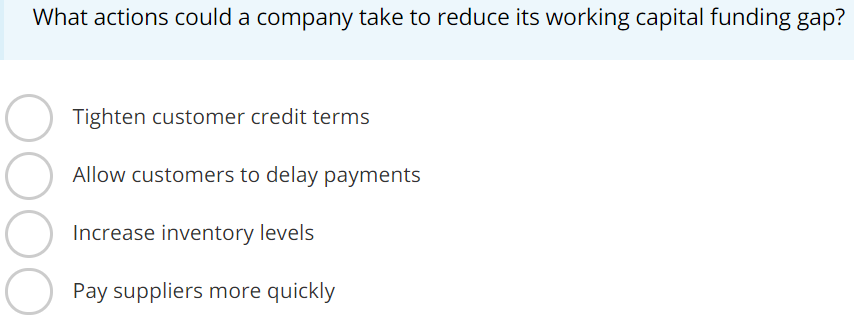

Also keep in mind that. By substituting 90 days instead of 45 days in the formula used above the working capital requirement doubles to 45000 or 247 of revenue. The action Company should take to reduce its working capital funding gap by Increasing inventory levels.

It is a planned process because it means you have thought about all these possible problems and made plans for them. We recognize that all business owners need an injection of capital at different time and for different reasons to keep the business running and growing. Working capital is the cash used daily cover all of a corporations.

The entire reduction stems from better inventory control. Theres no change in current liabilities.

Working Capital Cycle Day Ratios Financial Edge

Cash Conversion Cycle Formula And Calculator

Power Bi Working Capital Funding Gap Youtube

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

Days Working Capital Definition Formula Calculation

Solved When Calculating The Quick Ratio Or Acid Test Which Chegg Com

How To Close The Working Capital Gap By Obtaining Working Capital Financing Via Alternative Lending Solutions Arviem Cargo Monitoring

Research It S Time To Close The Gender And Racial Funding Gap 2022

Reliant Funding Working Capital For Your Business

What Are State Rainy Day Funds And How Do They Work Tax Policy Center

5 Reasons To Seek Business Funding Small Business Finance Float

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Funding Gap Problem Water Cooler Analystforum

Working Capital Formula Calculation And Example

Working Capital Financing 101 For Entrepreneurs

Cash Conversion Cycle Formula And Calculator

Credit Analyst How We Calculate Working Capital Funding Gap The Wcfg The Period Between Company Pays For Inventory Cash Out And Company S Customers Pays For Goods Cash In طريقة الحساب

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates